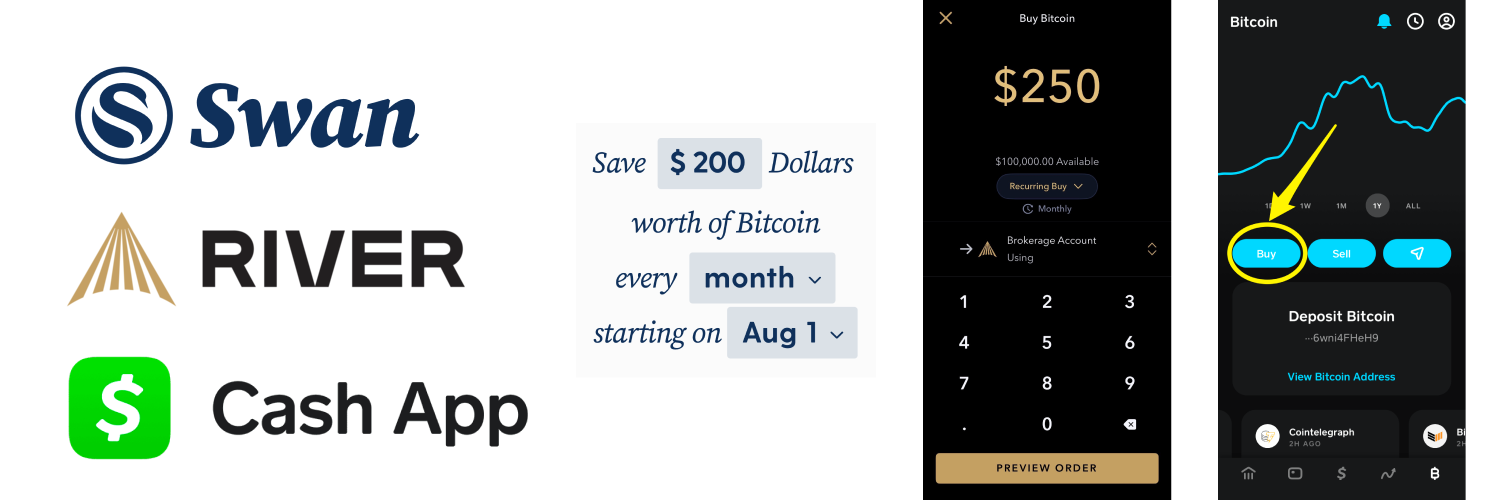

One of the smartest ways to buy Bitcoin is to dollar cost average (or DCA for short) your money into the asset. This investing strategy can reduce your stress and make investing in Bitcoin automatic. If you participate in a 401(k) plan through your work, you’re probably already using DCA as an investment strategy. Every paycheck, some money is automatically moved into your 401(k) retirement account and buys the mutual funds (or other investments) that you chose when you signed up regardless of the price of those funds. Each month, you buy more and more, and as the investment goes up in price your total value increases. If the asset (index fund, or Bitcoin) drops in value, you get to buy it at a discount!

Let’s take a real life example. The average household income in the US is about $60,000/year. In 2021, Americans are typically saving about 10% of their income. This means that the average American should be able to save about $500/month. Each year, that’s $6,000. Over 5 years, you’d have $30,000 in your savings account.

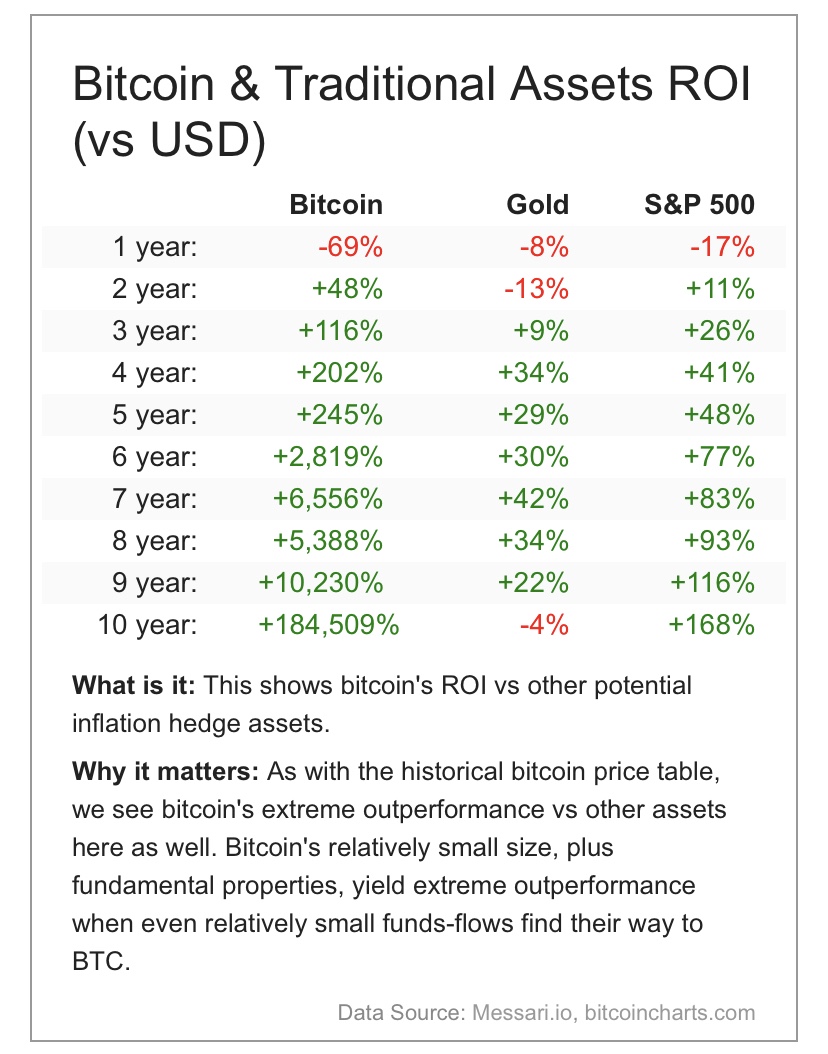

Now, let’s imagine you had invested that $500/month into a savings account and earned a 1% interest. After 5 years, you’d have $30,749. Had you invested in the S&P 500 over the same time period, you would’ve ended up with $43,097 since the stock market returned around 14%/yr during those 5 years. So, the next question is: how much would your $500/month savings be worth if you had bought Bitcoin (BTC) each month for 5 years?

Read more