If you own any stocks or mutual funds, you might wonder how Bitcoin compares as an investment option. Legally, under US law, Bitcoin has been classified as a commodity under the Commodity Exchange Act (CEA). Gold, silver, and copper are examples of commodities. Many professional investors recommend having some percent of your investment portfolio in gold. So, how about Bitcoin?

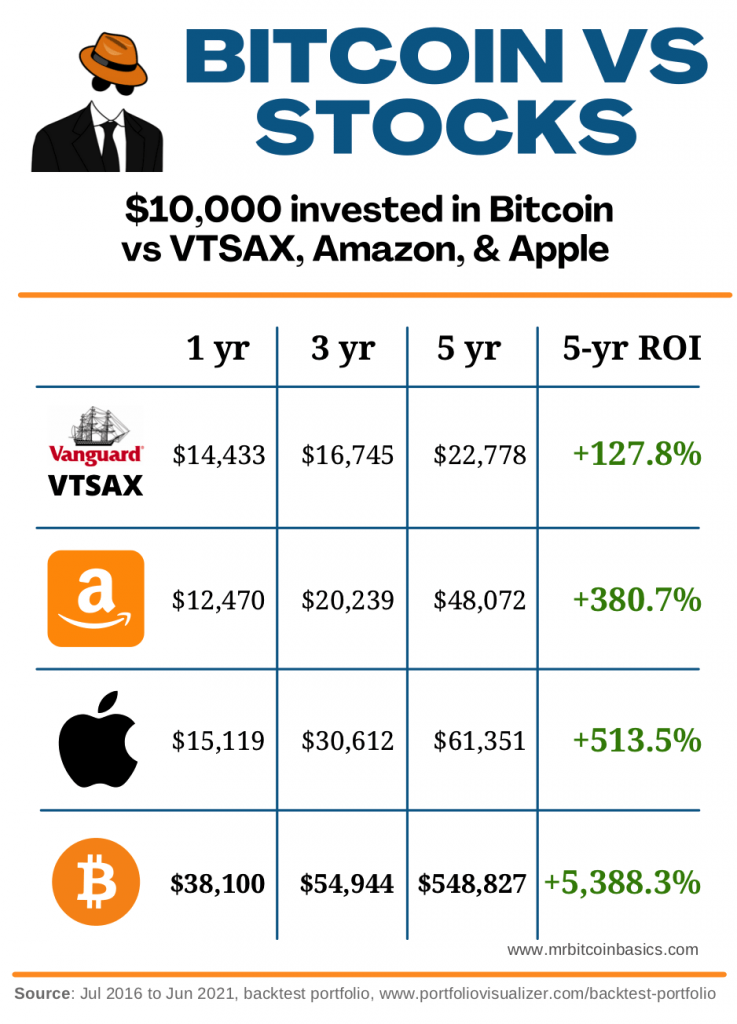

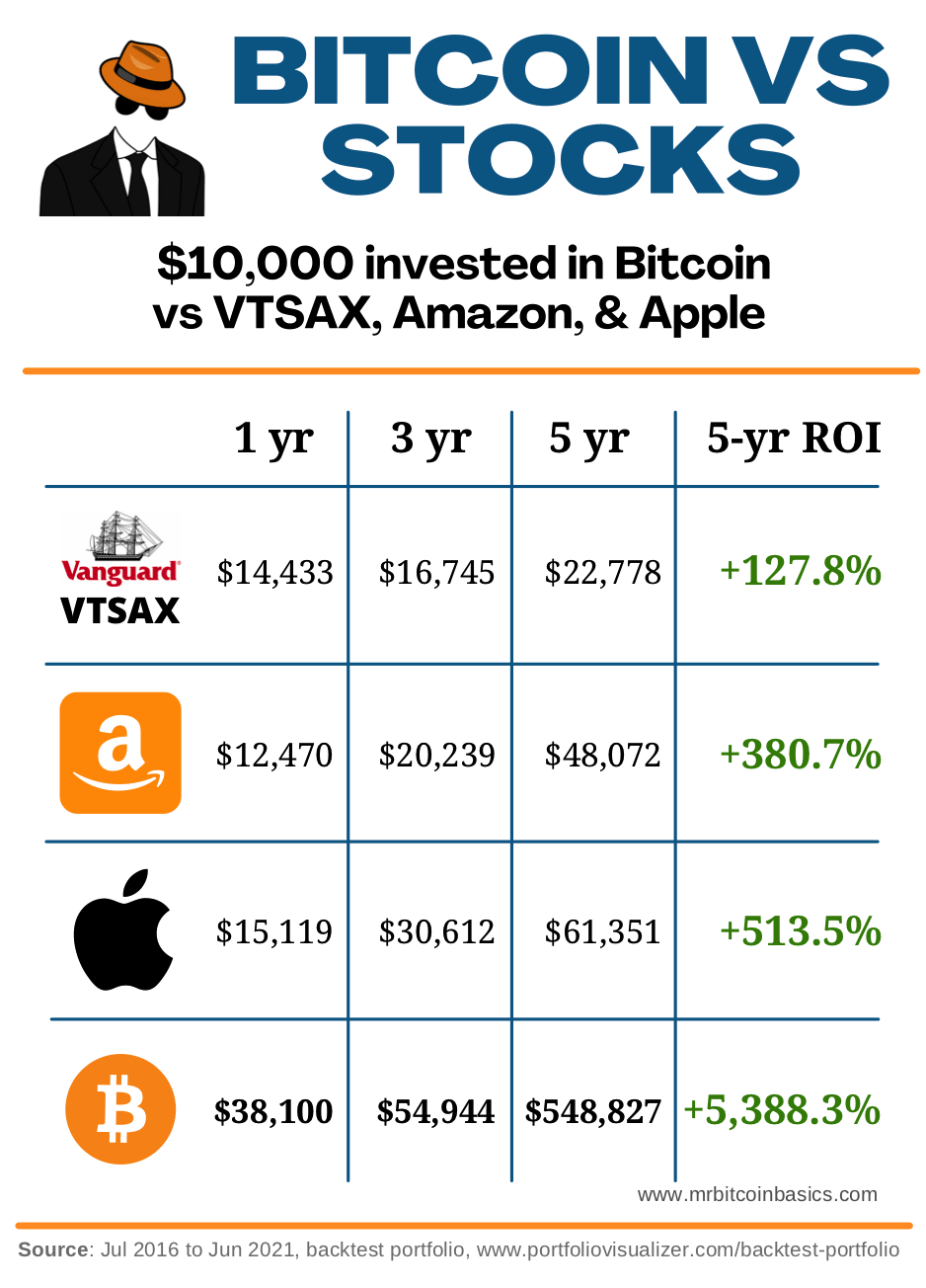

Traditional investment advice recommends a diversified portfolio of broad index funds like Vanguard’s Total Stock Market index (VTSAX). Newer investors have seen the phenomenal returns of tech stocks like Amazon (AMZN) and Apple (AAPL) in the 2000’s. How does Bitcoin compare to these two tech stocks and the famous index fund? Let’s see how $10,000 invested in each of these has performed since the Summers of 2016, 2019, and 2020.

As you can see, you would’ve more than doubled your money from 2016 to 2021 had you purchased a broad index fund like VTSAX. Amazon has grown to be the 4th largest company on Earth, worth $1.6 trillion. Had you bought Amazon in the Summer of 2016, you would’ve doubled your money in only 3 years. And more than doubled it again by 2021, only 5 years after buying it.

Apple is the biggest company in the world valued at more than $2 trillion. In just 5 years, your $10k would’ve grown to more than $60,000! That’s a 5x return (500%) in a short amount of time.

Bitcoin beats AMZN, AAPL & VTSAX

Now, let’s look at Bitcoin. From the Summer of 2016 to the Summer of 2017, your $10k would’ve almost quadrupled to $38,000… in one year. In 3 years, 2019, your Bitcoin would’ve been worth almost $55,000. Surely, the old motto “what goes up, must come down” should apply. Not in this case. In 5 years, your initial $10k investment into Bitcoin would be worth almost $550,000! What other investment do you know of can turn $10k into more than half a million dollars in just 5 years.

It’s clear that Bitcoin has been the best performing asset of the 2010’s. The good news is that you don’t have to buy a whole Bitcoin to get the returns. A person who had only bought $100 worth of Bitcoin 5 years ago would have $5,488 worth of Bitcoin in the Summer of 2021. Buying even a small amount of Bitcoin has paid off in a big way.

Will Bitcoin continue to outperform a diversified portfolio of VTSAX and tech stocks like Amazon and Apple? Time will tell. Are you willing to not own Bitcoin for the next 5 years to find out? Or would you rather buy a little “just to see what happens”?

The ultimate casino adventure is calling — answer at betmgm casino! Claim 100% match up to $1,000 plus $25 free. Play anywhere, win everywhere.